There are a number of things you can do to increase the size of your tax refund. One of the key ways to do this is by taking advantage of tax deductions.

Being able to deduct things like healthcare expenses, mortgage interest, dependents, energy efficiency improvements, etc. helps lower the tax bill for many Americans each year. And, in many cases, can result in a tax refund at the federal and/or state level.

With this in mind, we were curious about which personal expenses taxpayers think should be tax deductible, but currently aren’t. So we asked them.

Tax Deduction Survey Results

We conducted a survey in which we asked 1215 Americans the following question:

From the following list, which options do you most strongly believe should be tax deductible for all US taxpayers (you can pick up to 3)?

We also asked them to give a reason why they selected the items they did. Here’s what we found:

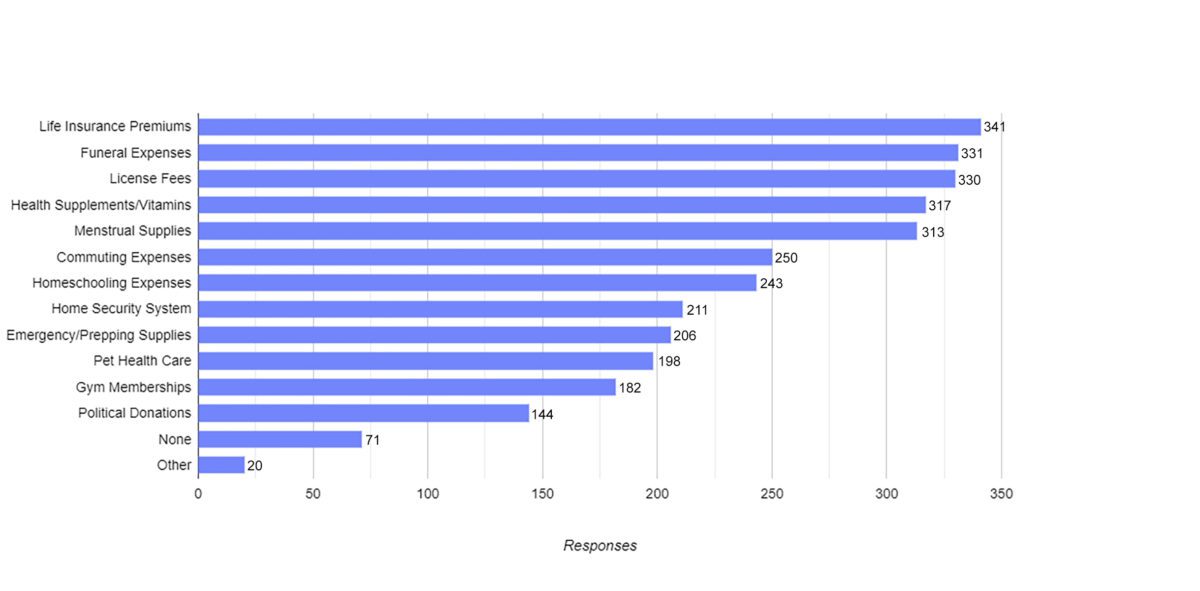

Of the 14 options on the list, the thing most people want to see as a tax deduction was life insurance premiums. That option was selected by 341, or 28.1% of respondents.

There is essentially a tie for next two items from the list people want to write off. These two expenses are funeral expenses and license fees (like driver’s and marriage). 331 respondents (27.2%) chose funeral expenses and 330, also 27.2%, selected license fees.

So basically, when it comes to expenses related to death and government fees, taxpayers think they should be able to write off those costs.

To round out the top 5 items from the survey people want to be tax deductible, there are 2 health related expenses. The first is health supplements and vitamins which 317 respondents, or 26.1%, want to be a tax deduction. The other is menstrual supplies which 313 respondents, or 25.8%, want to write off when it comes to taxes.

Here is a chart of the results that show how many people selected each item on the list:

Tax Deduction Survey Results Infographic

Please include attribution to WhereIsMyUSTaxRefund.com with this graphic.

Why People Think These Expenses Should Be Tax Deductible

The other part of the survey was asking people why they think the items they selected should be tax deductions. In combing through the comments, there were a few clear trends.

Unavoidable Expenses

A key one is that people think unavoidable expenses should be tax deductible. The thought being that if you don’t have a choice in paying for something, then the government should help you out and let you deduct that from your taxes.

A number of respondents wrote that, since everyone dies, expenses related to death such as life insurance and funeral expenses should be write offs. For life insurance, one other thing people mention is that the person paying the premiums isn’t the one who ultimately benefits. They’re paying it to take care of their dependents. So they should be able to deduct those premium costs.

For funeral expenses, some make the case that it’s actually saving the government money since the government doesn’t have to pay for the burial.

Saving the Government Money

That theme of saving the government money comes up for a number of other items on the list too. Some make the case that both life insurance and funeral expenses save the government money. Others point to things such as health supplements/vitamins and gym memberships here too. The thinking being that things which improve people’s health help keep healthcare costs lower.

One other expense that falls into this category is homeschooling. A number of people make the case that homeschooling means the government has to spend less on education so those expenses should be tax deductible. One person commented how this should be especially true during the COVID pandemic where some people don’t have a choice but to homeschool.

The Essentials

Another key theme in the responses are that essential items or things people are required to buy should be tax deductible. Government license fees and menstrual supplies fall into this category.

Security

People also feel that items that provide security for American families should be tax deductible. Expenses from the survey that fall into this category include life insurance premiums, home security systems and emergency/prepping supplies.

Help For Low- and Middle-Income Families

Lastly, there were people who feel that many expensive items on the list should be deductible to make it easier for low and middle-income families to afford them.

Comments

Here is a sampling of comments from respondents:

I don’t believe that the federal or state governments should offer tax deductions.

They are things you can’t really avoid in life, so they should be able to be deductible.

They are better for society if it’s available to everyone.

They are necessary things that people need, not hobby or “lifestyle” related expenses

These are places where a tax credit could have a major impact on a lot of people who need the money.

Menstrual supplies because women can’t help that they need them, they are necessary.

Those are basic human needs. thank you.

Because they are important and not frivolous.

I think parents should be able to deduct what they spend on schooling their kids. With home security there is a better chance of not using local authorities such as police when in use. Thus you save the local government money.

These are items that will make people healthy and cut down on medical costs

Health improvement costs us all less.

Pets are just like family. Humans can get a deduction off of prescriptions so pets should be able to as well.

Pets can be as expensive as children sometimes and their care reduces burdens on publicly funded shelters. Everyone who menstruates needs menstrual supplies for medical reasons, and license fees are basically like an additional tax.

These are household or personal health basics that everyone should have on hand and not fear running short of during times of severe weather, pandemics or economic tough times and it would be more motivating for people to keep them on hand or stocked up in case of shortages if they had a tax incentive as well.

Because if people are healthy less finding goes to healthcare.

I believe these three items should be tax deductible as they are unavoidable items, not covering any personal or material advantage.

They seem like necessities for a lot of families.

Because they are expenses that are necessary in life and health care.

Because the majority of people deem them necessary.

These are all the essential features for human so tax should be deductible.

They are costly items that cannot be avoided by most people.

I believe these health-related items are common and should be deductible, as they can be construed as necessary for possible mental and physical health.

Life insurance helps cover the costs of death so people do not have to dip into savings, Gym Memberships hypothetically make people healthier so as to not take away as many health service resources, and License Fees are unavoidable government expenses that should be allowed to be deductible.

Funerals are big events in one’s life, so being able to get some tax relief when a loved one dies would help a lot of people. Also, you may end up having to miss work and other things like that, so having it be tax deductible makes sense in that regard.

Commuting to/from work costs a lot of money and can be a huge hit to one’s finances, and it’s related to your employment usually, so making it tax deductible makes a lot of sense.

Homeschooling is something that should be tax deductible as well since there are a lot of expenses associated with this if your child isn’t going to public school. Also, not going to public school means your child isn’t taking up tax resources.”

Because they help make families stronger and better to function in society.

I believe these should be tax deductible because these are mostly unavoidable expenses.

They all pertain to quality of life – it eases the burden on individuals and families in times of emergency/need.

I think commuting expenses should be tax deductible because these are business expenses that are not reimbursed for most people. I think license fees should be reimbursed because these should not cost anything because it is a government service. I think homeschooling expenses should be tax deductible because we need to invest in the children.

These are issues that poor people have to deal with and they should be tax deductible.

I think that they should be deductible because fees for important like needs and events like driver’s licenses and marriage should be something you can deduct. Same with funeral expenses because they can cost so much.

We want to encourage people to get licenses and prepare for emergencies. Also, funerals are bad enough already.

Because everyone dies.

They’re things people generally don’t have a choice in so taxes further affect people who already struggle financially and can’t choose whether to cut them out to save money

Funeral expenses are expensive enough, taking tax deduction from gym memberships would get more people to join and menstrual supplies are an expensive necessity. You should also add diapers/formula.

They are important and responsible decisions for people to make or something from an unfortunate circumstance.

The license fees are already being paid to the government, one should not have to also pay taxes on that money.

Health supplements and gym memberships ensure that we are healthy and live longer so that we can continue paying taxes into old age. License fees should be tax deductible because they are required by the government and we shouldn’t have to pay for them in the first place. They’re not cheap, so we should get a break on them.

To keep the preparation of taxes simple, none of these items should be deductible.

Homeschooling expenses because taxpayers pay for the public education system. So those who homeschool are paying for both homeschooling and the public education system – double payment. License fees and funeral expenses because these are expenses that are required and cannot be avoided.

These are things that your tax money is supposed to already go towards but you’re required to essentially double pay. They should be tax deductible as a result.

These items are all necessary. Everyone dies at some point, therefore funerals should be paid for in order to decrease the money that is normally spent on them and repurpose that money somewhere else in life. People with a uterus do not choose to menstruate, therefore menstrual supplies should be a right, not a privilege. And we all have to travel sometimes, which is why commuting expenses should be tax deductible, and leave more spending room for others.

Because they are either unavoidable (funeral expenses, at least to a certain extent) or good for a person’s health (gym membership) or their family (life insurance).

Homeschooling expenses because if you have children the government should help you a tiny bit with their expenses. Life insurance because everyone should have it and if you can’t afford it it’s important that the government gives you a chance to obtain it either way. Commuting expenses are sometimes mandatory for a lot of people it would be really nice if they could be tax deductible.

I see these as 3 that would be beneficial to society to have as tax deductible. Gym memberships would provide opportunity to lower income individuals to stay healthy which could help reduce health care costs. Funeral expenses would also reduce the burden on lower- and middle-income families on burial or cremation. And any licenses and fees should not be forced on the taxpayer at full price.

I was going to choose 2-3 answers but when I thought about it then you’re opening a whole can of worms. Like with menstrual supplies, I was going to say yes to this and then I though about adult incontinence diapers and pads should be covered. If they’re deductible though, then you’ll have parents wanting to claim deductions for baby diapers. It just gets too complicated and I think people will take advantage and try to expand exemptions until no one is paying taxes.

It’s simpler not to have anything tax deductible. In the big picture, it will be a wash (lower overall taxes) and we reduce opportunities to cheat.

A large percentage of Americans own pets but the pets’ healthcare expenses are sometimes exorbitant. We should be able to deduct their healthcare expenses. Commuting expenses should also be deductible because they are essential for most workers to get to and from their jobs, and some people expend

I believe that menstrual items should be tax deductible because menstruating people cannot control menstruation, it is a natural phenomenon that happens in the body. The products are also exponentially expensive. I believe that funeral expenses should be tax deductible because death is unavoidable and really tough on families. It is a part of life, yet very expensive to cover. I also believe that emergency/prepping supplies should be tax deductible because emergencies happen, often with little warning. Everyone deserves to be able to prepare themselves and their families in case of an emergency.

Because all of these things are certainties: there will be emergencies, women will have periods, and we will die. We shouldn’t pay taxes on those things.

These are things that the government says we need or are things that we need in order to take care of our loved ones if they should pass away. It’s just the decent thing to do.

Emergency supplies would help offset the need for first responders, license fees are taxes in and of themselves, and a gym membership would increase overall health, thereby reducing healthcare costs.

I think these should be tax deductible because they are not a choice. They are things that happen to people (like menstruation or funeral) or are required by law (license fees).

I feel these should be tax deductible because we have to do them and we have no control over getting our menstrual cycle, someone passing away, and having to file these licenses with the state.

Funeral Expenses because it may help someone whose family has lost income event they could not control. Homeschool expenses because they are already paying taxes that go to support public education they are not using. Home security systems because it makes them safer, helps prevent crime or secure arrests lowering costs of policing incarceration.

Everything we buy and live off of should be taxed deductible. The politicians in Washington, the Hollywood actors and athletes all get big tax breaks and loopholes, why not us little people.

Menstrual Supplies are essentials and taxing these amounts to discrimination against the female sex. License Fees is paid towards the government for some services. So it makes sense to be able to exclude these costs from the taxable income.

Because having life insurance sets up future generations to have something when their family dies and is important.

A lot of these are expenses that I feel are needed for life; funeral expenses take a toll on families that are already struggling. Insurance premiums should also be deductible because it feels like insurance is predatory and thus the government needs to try and help with these expenses. I also feel like license fees are also ridiculous; a lot of people need to drive to work, or have to have a license for their work. If it is necessary to do their job properly or to even get to their job, I feel it should be deductible.

Menstruation and death are both biological certainties.

Because these are the things my taxes should be used for instead of lining the pockets of large corporations and defense contractors

Licenses are required by the government, so they should absolutely be tax deductible. Homeschooling expenses should also be deductible because parents are having to spend additional money to give their children an education that the public school system is failing to provide. I believe we should be able to deduct expenses for commuting to work because we are able to deduct other work-related expenses and commuting can be very expensive.

Funerals are so costly, and are such a burden on families that they deserve to be deductible just to help them out. Licensing fees should be deductible too, because it seems unfair that someone has to pay money to get a certificate to show that they’re married (or whatever), and they will never be reimbursed for it. And lastly, vitamins and other health supplements should be deductible (within reason), because people who are proactively trying to stay healthy will stay out of the healthcare system for longer and not require taxpayers and the government to pay for their care in some form or another in the future, should they have no private insurance or require additional help.

You have to spend money to get to work. If you invest in life insurance, it should be deductible since you will not profit. Your funeral expenses should be deductible since that money cannot be left for your family.

This would save the government money in the long run and encourage people to live healthier lifestyles.

These items are necessary to maintain healthy lifestyles (commuting to work in order to support oneself, taking care of health by taking vitamins, and being able to take care of pets who provide emotional support).

These items have to deal with health related issues and morality. Our health should be of great concern and many do not receive the aid that they need due to that. Making them tax deductible might help with that.

These items are not luxuries, they are necessary for many people to live and work, but they are a burden on the average person’s income. Allowing them to be tax deductible would be a good first step in helping people to escape from the cycle of poverty.

Commuting is required in order to pay any tax, so should be deducted. Life Insurance and Funeral Expenses ensures no-one is out of pocket in the event of deaths.

On licenses, the government already received money. Homeschooling is education like provided in public schools. The government should not further benefit from a death.

Supplements can help one stay healthier and less sick not using health insurance, which is a pretax deduction. Life insurance is money one will never see as it will not be paid out to them but to beneficiaries. Could possibly keep some off welfare when a tragedy happens to a family unit. Homeschooling expenses should be deducted as it is extra expense on a family unit to educate a child(ren). They are self funded not receiving federal and state money for education from taxes.

Too many tax deductions. We should just pay our taxes and fill out a simplified tax return.

Life insurance should be deductible because responsible people buy it to pay the cost of their burial and to take care of their families, so the government won’t have to. Of course it should be tax deductible.

Emergency supplies and funerals should be tax deductible because they are beyond people’s control and are traumatic events. Being able to take a tax deduction would lesson the burden and trauma.

Licenses and life insurance are all but required, and funerals are unavoidable. Everything else can in at least most cases be optional, but those three are mandatory. In the case of funerals and life insurance, they’re also two of the most expensive things on the list.

Life insurance helps families, funeral expenses take up a lot of a family’s savings, pet care can often be exorbitantly high if the pet gets ill.

Because these are the things that people will 100% need. You cannot tun away from funeral, neither from menstruation. Regarding life insurance – people need to be “rewarded” for acting responsible.

Life insurance is an important aspect of person’s life giving him and his family a cover if something goes wrong. Pet healthcare too should be tax deductible as pets needs care and if it is tax deductible, they will receive better care.

I believe that security systems should be tax deductible as the need for such a system generally implies crime problems in a given area – a failure which can often be directly attributed to local government, in my experience. The deduction here would represent a partial property tax ‘refund’ for the local govt’s inability to fully protect its residents. Funeral expenses and life insurance premiums should be deductible as these costs can be crippling for low-middle income households.

If you’re forced to homeschool due to something like a pandemic, any expenses that would otherwise been covered by taxes for public schools should be deductible. Menstruation is something that is natural and not exactly voluntary, and it’s unfair for people who menstruate be forced to pay taxes on something that half the population doesn’t have to worry about. And we’re all going to die, and the thought of having to pay taxes on something inevitable like burying someone seems bizarre and grotesque to me, especially seeing how expensive it already is.